By Eric Haggstrom, vice president of business intelligence and head of forecasting

Retail media has grown in share of the market over the past few years, but most of this spend has gone to retailers’ own sites and not to the rest of the ecosystem.

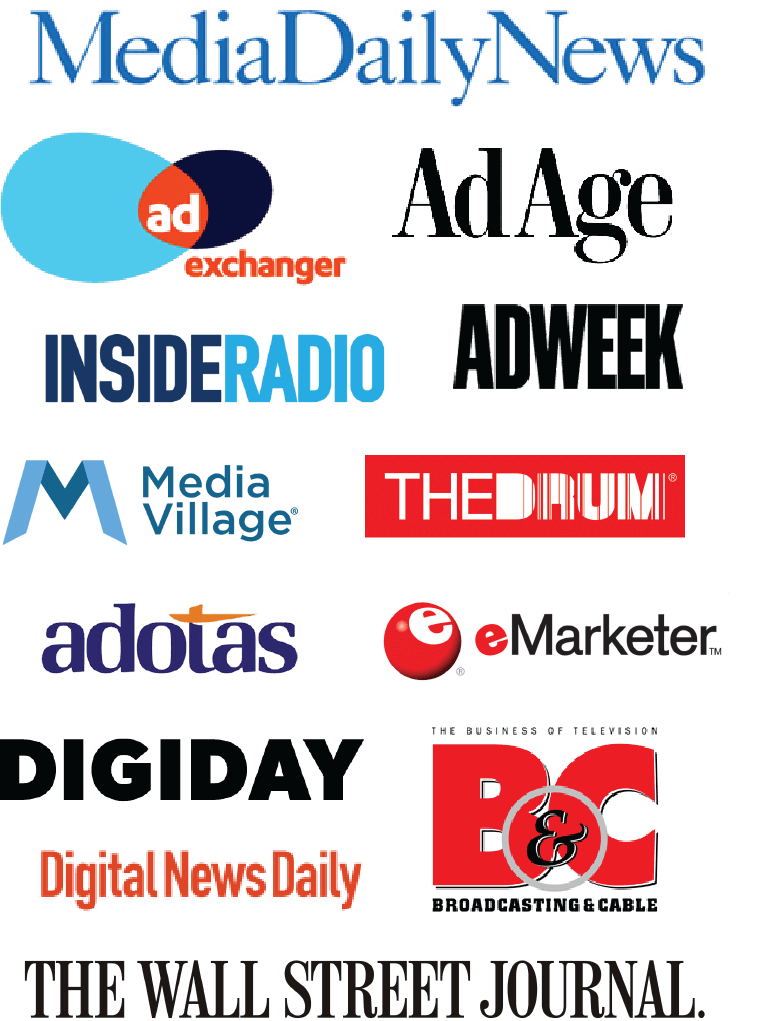

For forecasting and market-sizing purposes, we split retail media into two separate but related categories, onsite and offsite. Onsite retail media includes ads that are placed on retail properties such as websites and apps, while offsite includes advertising placed anywhere else that is bought via a retailer-owned buying platform or via a traditional demand-side platform (DSP) or other buying platform and utilizes retailer-owned data.

Until 2022, less than 10% of retail media spend went to offsite placements, however this share grew dramatically in 2023 to 15% and we expect further strong growth moving forward. By 2027, we expect offsite retail media spend will reach $29B in the US, accounting for over a quarter of all retail media spend and 6.1% of the entire advertising market. This channel surpassed 1% of total advertising spend only in 2022 and continues to grow.

Several tailwinds have led to this rapid offsite retail media growth. Simply put, these ads perform well and help advertisers achieve full-funnel goals; they are no longer just a lower-funnel strategy. Closed-loop measurement that can tie advertising activity to sales data is another key differentiator. Additionally, Wall Street is looking for profitability from retailers’ ecommerce properties, which is incentivizing retailers to grow their ad businesses both on- and off-property. This includes prioritizing advertising sales in negotiations with suppliers and brands. Limited onsite inventory is pushing more spending offsite.

As we move to the back half of 2024, publishers that can attract spend through retail media buying platforms and retailer-partnered ad tech companies will see outsized growth relative to competitors. For publishers and media companies, there’s an opportunity to capture and convert shopper and trade marketing budgets into retail media advertising.

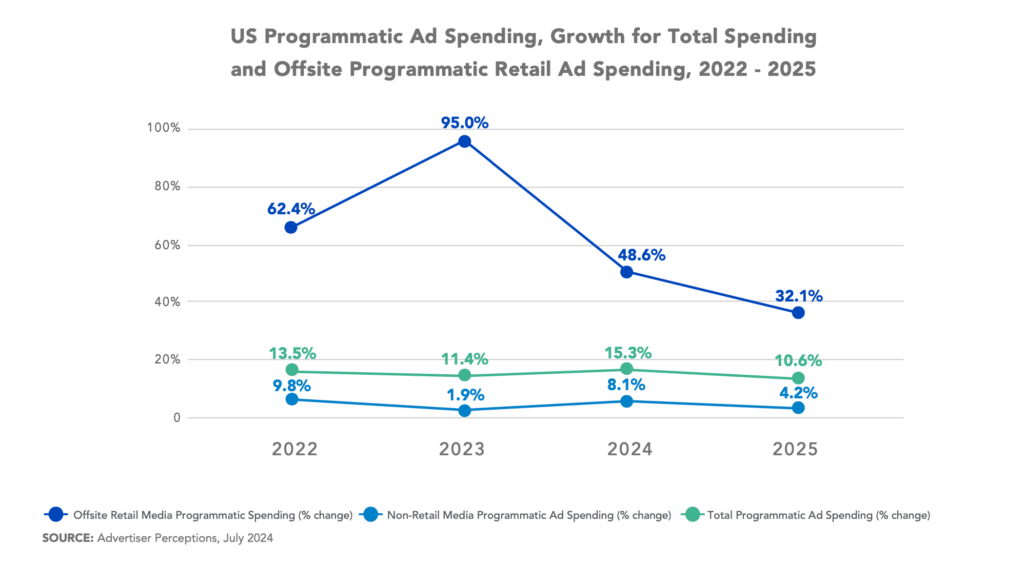

Programmatic spending using retailer data will grow about 50% year-over-year in H2 2024, while all other programmatic spending will grow less than 10%, largely driven by increased investments in programmatic CTV. For added context on how rapidly programmatic retail media ad spending is growing: This segment of the market grew 78.2% and 91.1%, respectively, in 2022 and 2023, while all other programmatic activations declined roughly 5% in both years.

Finally, one other area of retail media that’s worth highlighting is a new estimated breakout for us this quarter: Onsite retail media video advertising. Onsite retail media video advertising was a $1.4B market last year and is expected to grow to $3.6B by 2026. Amazon Ads has seen significant growth in the space over the past few years, while others including Walmart Connect, Sam’s Club Member Access Platform, and Instacart have launched competing products, making this an area worth watching.