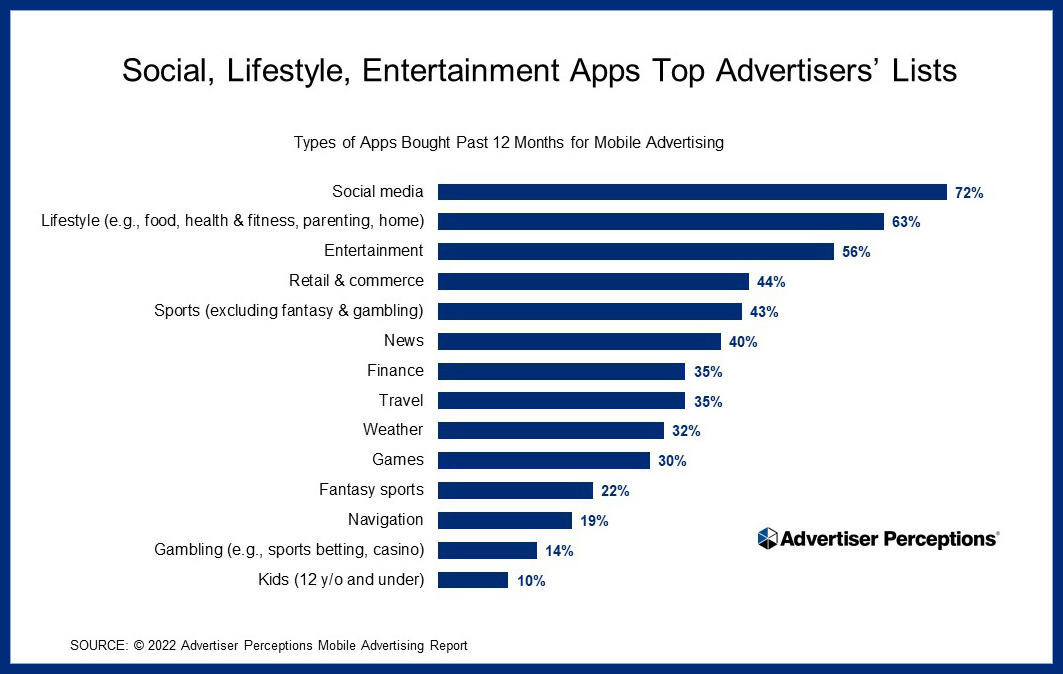

Advertiser Perceptions finds that US mobile app advertisers prefer to buy advertising in social media, lifestyle and entertainment apps. Only 30% of advertisers spend on mobile games. For advertisers still sitting on the slide lines of in-game advertising, nearly half cite brand alignment issues, with many admitting that they could reach their target audience if they were to spend on the category.

Mobile apps offer many benefits for advertisers. While social media apps offer scale, other popular categories such as lifestyle apps deliver highly targeted, contextually relevant placements. Mobile gaming apps offer massive scale, yet many advertisers have yet to dip their toes into this high reach medium.

- Social media apps remain the most popular choice. Nearly three in four (72%) advertisers spend on social media apps, followed by lifestyle apps and entertainment apps.

- Advertisers that advertise in mobile gaming apps are in the minority, despite popularity with audiences. Only 30% of advertisers spend on gaming apps.

- Non-spenders cite brand alignment issues with gaming apps. Of advertisers avoiding gaming apps, 47% cite a lack of brand alignment as the major factor keeping them away from the category.

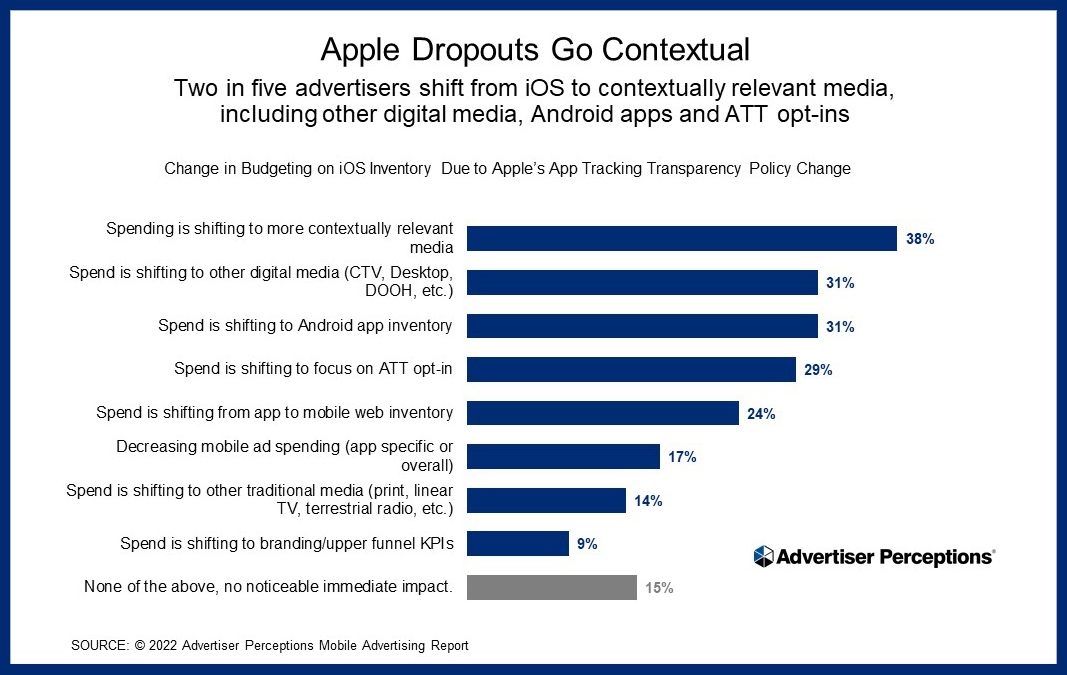

- iOS advertisers are shifting spend to other contextually relevant media. Two in five advertisers are moving money away from iOS as a result of its app policy changes, preferring other contextually relevant media instead.

“Mobile app advertisers continue to avoid gaming apps despite their enormous popularity with audiences. Citing brand alignment issues, many advertisers prefer social media, lifestyle and social media apps. For advertisers looking to reach younger generations in particular, gaming apps represent a potential opportunity for advertisers willing to test the market,” said Nicole Perrin, VP Business Intelligence at Advertiser Perceptions.

Popular apps

Social media apps reign supreme in a recent study where Advertiser Perceptions asked US media buyers what types of apps they had bought in the past 12 months for mobile advertising. At 72%, social media apps was the most popular category, including apps like Instagram, Facebook, YouTube and Snapchat. Rounding out the top three are lifestyle apps such as fitness, food and parenting apps, and entertainment apps which include publisher apps like streaming media.

Interestingly, only 30% of advertisers said that they’ve spent advertising budget on games in the past 12 months. This is despite the fact that games apps are by far the most popular apps in terms of activity on a daily basis. For those advertisers who do place ads in gaming apps, the most popular categories are action and puzzle games.

The most popular advertising styles used by advertisers who buy ads in gaming apps were interstitials, rewarded video and static display advertisements. Rewarded video in particular has been a relatively controversial ad type, with some advertisers sharing concern that the ad forces an action from the user. However, gamers have generally shown positive reactions to the format; for example, 2021 research from Tapjoy found that a majority of mobile gamers preferred rewarded video ads.

Game Changer

Perception is changing among advertisers avoiding gaming apps. According to our 2020 Mobile Advertising Report, these advertisers were most likely to say (42%) that they didn’t advertise in games because their target audience doesn’t play games. In the recent wave, only 36% cited this reason while 47% said that games don’t align with their messaging, an increase from last year. This raises the question: Given that more brands know that their audience plays games, will they update their messaging to align with games and start to spend in that category?

It’s important to note that larger advertisers are more than twice as likely as smaller advertisers to cite programmatic buying limitations as the reason they don’t spend on gaming apps. App publishers that make it easy for buyers to use programmatic channels may find that they attract brands that are considering trying gaming apps.

Bite Out of Apple

Advertiser Perceptions also asked mobile app advertisers about the effect of Apple iOS’s recent app tracking transparency policy change, an increase from November 2020. We found that 39% of advertisers say the change has not affected their mobile app spending, however a number of advertisers are bidding more or less aggressively on Apple iOS inventory. Advertisers bidding less aggressively may be doing so because they are less confident in their ability to track and measure ads on iOS apps. Conversely, the advertisers bidding more aggressively may perceive price favorability and may be using non-audience targeting methodologies that give them the confidence to take advantage of lower CPMs.

Overall, two in five advertisers are shifting spend away from Apple iOS inventory. Within that group, the most popular alternative is to buy more contextually relevant media (38%) followed by spending on other types of digital media such as CTV or desktop (31%) the same number who are shifting spend toward Android apps.

“Advertisers who historically spent on Apple iOS are starting to shift spend away due to a lack of transparency and measurability. With Google’s recent indication that Android may soon implement similar privacy changes, it remains to be seen how permanent this move is,” said Nicole Perrin, VP Business Intelligence at Advertiser Perceptions.

If you’d like more information about our Mobile Advertising Report – contact us at [email protected]